AMC Entertainment is a publicly traded company that operates movie theaters in major cities. The company is listed on the New York Stock Exchange and the Wanda Group has a majority stake. The Wanda Group purchased a $600 million investment in AMC in September 2018. The voting power of AMC shares is structured so that the Wanda Group controls most of the board of directors. AMC received a $600 million investment from Silver Lake Partners.

The company is the largest movie exhibitor in the U.S., Europe, and the world. It has cinemas in 44 states and 13 countries in Europe. It also operates multiplexes. It also offers food and beverages, including beer and mixed drinks. AMC Entertainment is one of the top film production companies in the world. While the company was founded by Stanley H. Durwood, it has expanded its operations worldwide. Its history has been influenced by the growth of the company.

AMC has a history of bringing Hollywood films to the masses. In 1932, AMC Theaters opened its first theater in Chicago. The theaters were the first cinemas to open on the Internet. Today, they offer the largest movie experience in the world. The movie experience in AMC Cinemas is truly unforgettable. Many people have gone to the movies at AMC Entertainment. Its locations are accessible for people with disabilities. AMC has been around for almost a century, and has been the standard for entertainment for families and children alike.

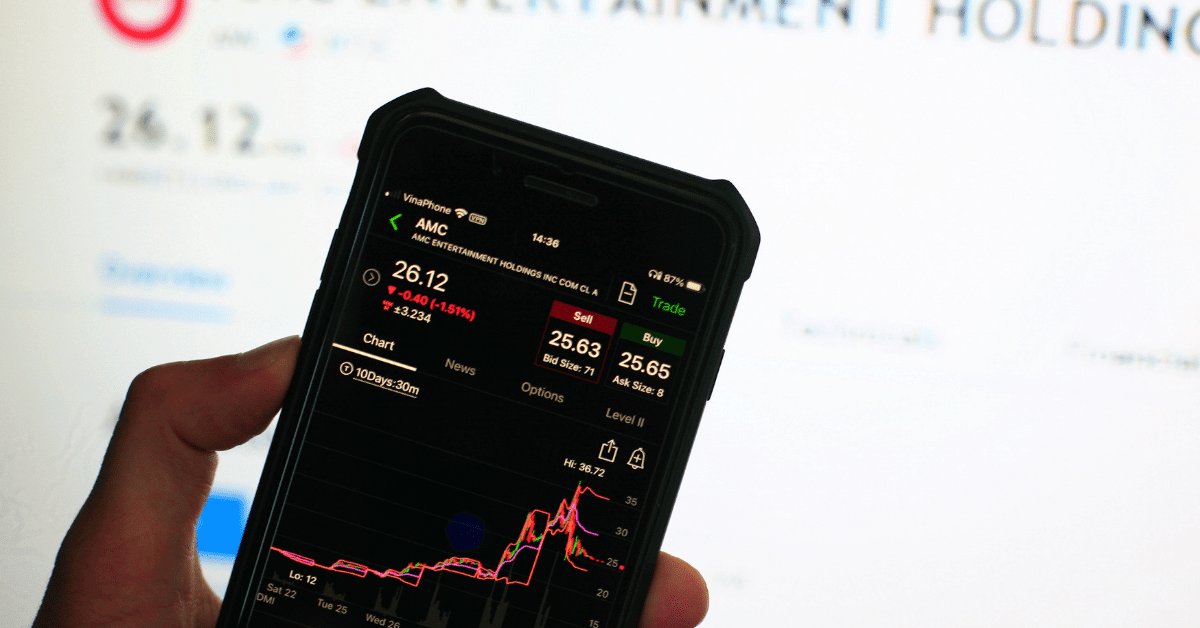

While the movie theater industry has remained a thriving industry, the company has also faced some tough times. Despite the many challenges that the company faces, the film business continues to thrive in the United States, especially with the recent recession and the onset of a pandemic. Its popularity has increased as more movie theaters reopen. However, the company’s stock price is elevated, leaving investors in a shaky position. AMC has been struggling to get customers back into its seats, resulting in a drop in top line revenue by 84%.

Despite the economic downturn, AMC’s performance continues to be impressive. Second quarter revenues rose to $437.6 million from $18.9 million a year ago. During the same period, the company’s net loss decreased from $561.2 million to $344M. AMC’s liquidity is now at a record high of more than $2 billion. This year, the company saw its biggest growth in its second-quarter results.

The stock’s value has been driven by a recent swoon over the past several years. AMC’s stock price has consistently outperformed the market over the last year. With a rising number of investors watching the movie industry, it is important to understand the risk-reward balance sheet of AMC. AMC’s balance sheet is the company’s latest financial information and reflects its strategic direction. If AMC Entertainment is able to improve profitability and increase profitability, it can achieve that goal and move into a much better position.

AMC is the third-largest exhibitor in the United States. Its stock grew from just two years ago to nearly $70 by June 2021, a record. As of December 2017, the company had 4,449 full-time employees and an IPO date of February 28, 2017. AMC is organized into two segments, the film business and the food and beverage industry. AMC currently operates movie theaters in forty-four states and the District of Columbia.

While AMC has historically focused on guests and profits, it continues to be a leader in the movie theater industry. AMC has added plush power recliners to the seats and expanded the menu. In addition, AMC has expanded its partnerships with IMAX and Dolby Cinema. The movie industry continues to thrive under the guidance of AMC’s founders. These companies have a strong reputation for providing quality entertainment. AMC’s success has been achieved through innovation and a focus on guests.

AMC Entertainment is a publicly traded company that operates through its subsidiary, American Multi-Cinema, Inc. Its theaters in the United States total over 200 locations. This makes AMC the largest multi-screen cinema operator in the world. As of December 2000, AMC had a combined ticket sales of $1.75 billion. Its growth has largely been driven by the acquisition of Starplex Cinemas in 2006. The company’s success has fueled a trend of innovation.

AMC Entertainment Stock Forecast and Investor Relations

The movie-theater chain AMC has made a bold decision to rebrand itself and drop the Carmike brand in favor of the AMC Classic brand. The company will also re-launch its smaller theaters under the AMC Classic brand. It will also discontinue the Carmike name. However, Aron is optimistic that AMC will be able to find rescue funding. AMC stands for America Multi-Cinema. With the money raised from Silver Lake, the company is poised for a renaissance.

The theaters were refurbished and upgraded. The seats were replaced with La-Z-Boy-style recliners, new projection, and sound systems were installed, and alcohol sales were experimented with. In addition, Aron supercharged the modernization initiative by buying two competing chains for $3.3 billion. In addition, the company has expanded internationally. Its history can be traced back to the 1920s when Stanley Durwood’s father was a struggling actor in a traveling tent show.

AMC has been in the business of movie exhibition for over 100 years. The company has approximately 950 movie theaters, and 10,500 screens. The theater chain has propelled innovation in the industry, introducing food and beverage options and loyalty programs to its patrons. Additionally, it plays a variety of content. Its most popular films include horror, thriller, and action movies. You can find an AMC in just about any town, and you’ll find something for every taste and budget.

The company is currently focusing on delivering a better customer experience. As the company grows, it has become more relevant to consumers. AMC’s CEO is playing to the Twitter horde with a Tweet declaring AMC overvalued. He said the movie industry needs an accelerated recovery from the coronavirus pandemic to grow, and that a resurgence of AMC is what it needs to remain competitive.

AMC’s financial situation is far from rosy. The company’s debt has increased to $4.9 billion in the past decade. AMC has been able to improve its credit score over the past decade with its acquisition of Kersotes and Loews theaters. It has merged with other theater companies to expand its reach and make a more profitable AMC. AMC’s debt may also cause the company to emerge with a lower share price.

AMC is an AMC competitor and is now owned by Silver Lake Partners. The Wanda Group held the majority of AMC’s shares until December 2018. In September 2018, the Wanda Group acquired a minority stake in AMC for $600 million. The voting power of its shares is structured so that it controls the board of directors. Therefore, the AMC’s future is in doubt, and there is no clear sign of it. But the company is a popular choice of investors, and it’s growing audience will ensure that it stays that way.

AMC has a history of developing innovative solutions for its customers. The company has opened over 8,000 locations across the United States and the District of Columbia. The company has more than 6,000 employees and employs more than 3,449 full-time people. AMC’s IPO was on December 18, 2013. The company’s operations are divided into two main segments: the AMC Stadium division licenses first-run films from independent distributors; the AMC Food & Beverage business provide concessions to its customers.

The AMC brand has long been associated with the movie theater industry. The company leased its first theater in 1920 and by 1981, AMC had more than 500 screens across its cinemas. Today, the AMC chain has over 200 locations in 23 states. AMC’s success in the cinema industry has led to numerous innovations in the movie industry. Its multi-screen concept began to gain ground in the 1950s. The film market has seen a dramatic change in the last century, and this is still reflected in the company’s continued growth.

AMC has been a leader in the multiplex industry. The company’s focus on guests has made it a popular destination for moviegoers. Its major shareholder, the Wanda Group, has made many notable decisions in the multiplex business. In its quest for better customer service, the AMC brand has expanded its menu and added more features to its theaters. As a result, AMC is the largest exhibitor in the U.S. in terms of total revenue.

[…] Also Read: AMC Entertainment Investor Relations […]

[…] Also Read: AMC Entertainment Investor Relations […]

[…] Also Read: AMC Entertainment Investor Relations […]

[…] Also Read: AMC Entertainment Investor Relations […]